In anticipation of transformation of Kazakhtelecom JSC: ecosystem of mobile provider and bank, partnership with QazPost JSC, and development of data centers and Sovereign Artificial Intelligence.

24.04.2024 21:20

In this report, Teniz Capital Investment Banking shares its assumptions regarding transformation of Kazakhtelecom JSC, which will permit to increase the competitiveness and profitability of the company in conditions of the permanently changing telecommunication market. Our assumptions are based on the development of a super-application for the ecosystem of digital services, expansion of business by introduction of marketplaces and partnership with QazPost JSC, streaming opportunities, and also investments in data centers and creation of Sovereign Artificial Intelligence.

Despite of significant capital investments during the last decade, the traditional business of telecommunication providers becomes more and more commoditized, that affects their growth which slows down. A major part of the profit in technological sector is gained by advanced players – by those who produce mobile phones, develop applications or create digital infrastructure. This trend is observed all over the world, and each significant telecom provider is in search for ways of diversification of its activity.

Development of ecosystem. Kazakhtelecom JSC will rest upon creation of a super-application combining mobile services, financial services and marketplace. The base for development is application of Kcell/Activ with product OGO Card, which issued 150 thousand cards by the end of 2022. The potential of growth is huge with 8 million Kcell users, and attractive marketing campaigns will contribute to expansion of the user base. If more than half of users become users of the super-application, quantity of active users can achieve 4 million thereby strengthening the company positions in the market.

Marketplace of Kazakhtelecom JSC, integrated in super-application of Kcell/Activ (according to our assumptions), will provide growth in rapidly developing field of e-commerce, which, according to data of PwC, grew by 79% for the half year in 2023. We predict purchase of QazPost JSC (or partnership) for consolidation of logistic and technological infrastructure, thereby strengthening the market positions to be comparable with Kaspi and Ozon. Also, partnership with Chinese marketplace PInDuoDuo is envisaged for expansion of accessibility of PinDuoDuo services throughout the whole country, thereby raising attractiveness of the service.

Merger of Kazakhtelecom JSC with QazPost JSC will bring additional synergy expanding the range of services in the super-application by means of financial and brokerage services of QazPost JSC. This will enhance the ecosystem by suggesting complex solutions to business including payments and logistic services.

Loyalty Programme. Telecom and media industry have a relatively low NPS (NetPromoterScore) index all over the world. We assume that Kazakhtelecom will actively develop the loyalty programme. This step will permit the company to bring in and hold customers by means of their incentivization for use of the company services. The programme will include bonus accumulation and offers from the company partners.

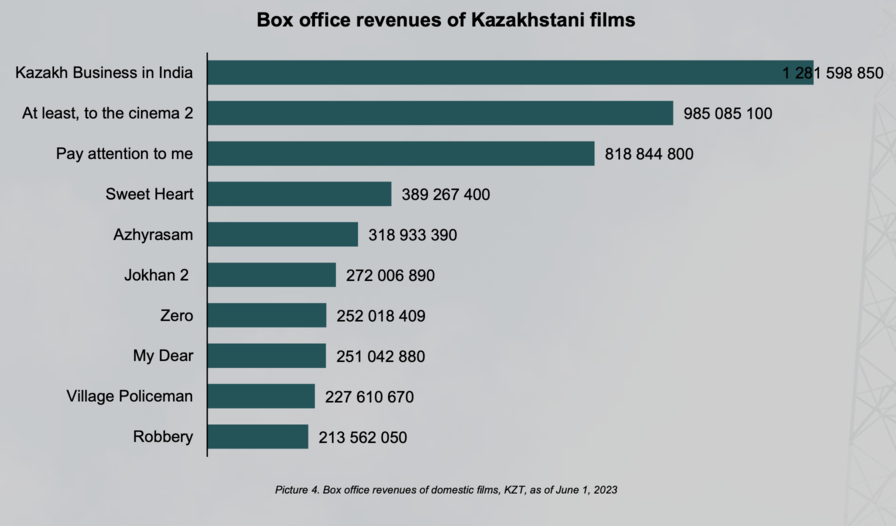

Streaming and digital TV are growing, and Kazakhtelecom is planning to strenthen its streaming business adding local content and sports broadcasting for rise of ARPU. Popularity of Kazakhsani films, such as Kazakh business in India, shows that local films are of high demand. Investments of Kazakhtelecom JSC in the national content stimulate media and film industry. Thereby contributing cultural development of the country.

Capital distribution. Development of 5G infrastructure and also business transformation demand high capital expenditures. Accordingly, we consider that the company is to de-prioritize payment of dividends, that will permit to develop the infrastructure and new directions of business for increase of the debt load. By the end of the third quarter of 2023, the consolidated net debt of the company was 239 billion tenge. With the company’s operating profit of 137 billion tenge for the first 3 quarters of 2023, the company’s debt load remains adequate. We consider that allocation of dividends to development of the company during the following several years will permit to transform the business and support sound financial standing.

Possible listing on a new platform. With achievement of the first significant results, it is worth to think about listing on a new platform with high liquidity. We consider that telecom provider with growing segments of ecosystem and marketplace business will receive high multiplier and will be of demand among investors.

Strengthening of the role of Kazakhtelecom JSC as a quasi-regulator. As it is supposed, sale of Tele2/Altel to Qatari group Power International Holding W.L.L will impose certain restrictions on development of the telecommunication business of Kazakhtelecom JSC (for example, non-increase of the market share during a certain term).

Read more in our report: